1) Median Price Analysis

GTA overview. TRREB’s latest Market Watch shows prices drifting lower year over year. In August, the MLS® HPI composite was down ~5.2% YoY, with the GTA average price at ~$1.02M (also ~–5.2% YoY). After seasonal adjustment, prices edged lower month to month.

Durham snapshot. Durham’s median price for August was ~$805,000 (average ~$860,951) on 676 sales—consistent with a cooler late-summer market and better selection for buyers.

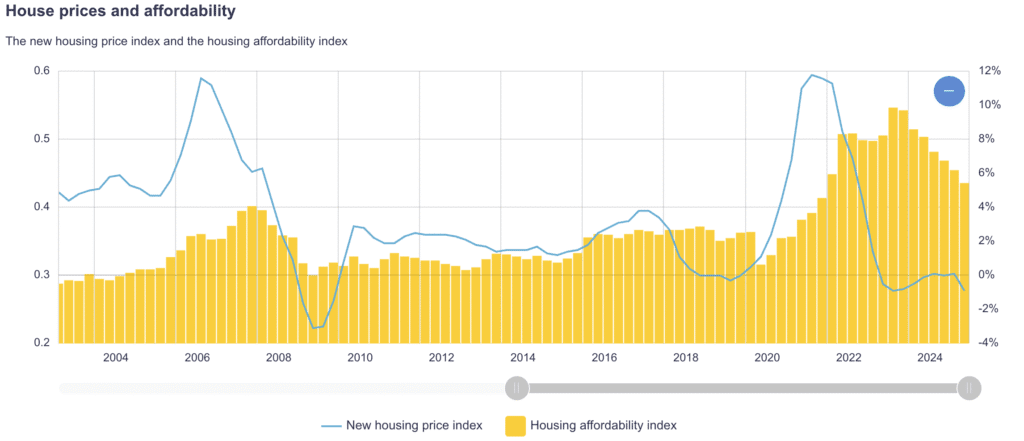

Are prices going down? Modestly, yes. TRREB’s August read confirms a multi-month pattern of stagnation/decline since late 2024; August also saw the first MoM sales pullback since spring. Influencer analyses note low-rise prices remain ~27% below the Feb 2022 peak, with no quick rebound in sight.

Is it a good time for buyers? From a negotiating-power lens: yes—more inventory, longer DOM, selective demand. From a timing/value lens: near-term price risk in Ontario remains mildly to the downside into 2026 as inventory stays elevated. Practically: patient buyers can negotiate on price and terms today, particularly in supply-heavy segments (many condo sub-markets and some 905 low-rise).

Affordability. Increased supply and lower borrowing cost vs. 2024 has started to create improved affordability typical GTA household purchasing the “average-priced” home.

2) Mortgage Rates

Where are rates today?

• 5-yr fixed (insured, best-case): ~3.9–4.2%

• 5-yr variable (insured, best-case): ~3.7–3.9% (e.g., prime – 0.80% ≈ 3.90%)

Fixed–variable gap. The spread has narrowed materially vs. 2023–24; variables are now within ~0.2–0.3 pp of competitive 5-yr fixed quotes, making variables plausible again for risk-tolerant borrowers amid an easing bias from the BoC.

Next Bank of Canada announcement. After a 25 bps cut on Sept 17, 2025 (overnight to 2.50%), the next announcement is Oct 29, 2025 (with MPR).

Economists’ outlook (rest of 2025–2026). Baseline calls for further easing into late 2025, then a “low-and-hold” in 2026 as inflation trends toward target and growth remains soft. Several desks see policy in the low-2s by end-2025, broadly stable through 2026 (data-dependent).

Be sure to connect with a mortgage professional for an indepth analysis of the mortgage market to determine which product is best for you and your scenario.

3) Rental Market (supply up, demand cooler)

Affordability for renters is improving at the margin. TRREB’s Q2-2025 rental report shows 1-bed avg $2,326 (–5.1% YoY) and 2-bed $3,066 (–3.5% YoY) GTA-wide—evidence that more supply and softer demand are pressuring asking rents. National trackers also show YoY declines into August.

Incentives are back. ~65% of GTHA rental buildings offered incentives in Q2-2025 (e.g., 1–2 months free). Effective rents can be ~12% below face rents.

Is real estate a good investment to hold now?

• Cash flow today: Challenging at current rents and financing; many condo investors remain near/underwater after all-in costs.

• Total return: For 5–10+ year horizons, quality assets in supply-constrained locations can still make sense if you can absorb near-term cash-flow drag. Forecasts point to near-term price pressure in Ontario but room for recovery post-2026 as supply pipelines thin and population growth normalizes.

Where did rental demand go? Are tenants leaving? Demand rotated: some buyers returned to ownership, some households consolidated or moved home; meanwhile, completions and investor listings lifted supply, slowing lease-up and prompting incentives.

4) Investment Market

Are investors making cash flow? On average not yet, especially condo investors with today’s carrying costs. Select freehold suites (e.g., duplexes/garden suites) can pencil closer to neutral/positive in sub-markets with stronger rent-to-price ratios—underwrite conservatively (rent, vacancy, capex).

Price appreciation outlook. Base case is flat-to-negative into late-2025/2026 in Ontario, with potential improvement beyond that if the policy rate holds near the low-2s and new supply shrinks (muted pre-construction today → fewer completions around 2027+).

5) Condo Market

Right now. Condos remain the weak link.

Price per square foot (psf). Resale values eased from ~$1,000–$1,050 psf at the 2022 peak to the low-$800s psf in 2025 (≈ –15% to –25%). Central Toronto examples that cleared $1,000–$1,175 psf now trade ~$790–$960 psf. Pre-construction ask is roughly $1,150–$1,325 psf (typically –7% to –20% from peak), with incentives pushing effective psf lower; recent developer-held inventory hovered near ~$1,200 psf, down from two years ago.

Durham angle. Same downtrend with lower absolute psf than the 416 core; buyers have leverage in most sub-markets. Status-certificate review, fee trends, and pre-inspection matter more than ever.

Bottom line. End-users can secure bigger/better suites for the money; investors should assume range-bound psf until excess inventory clears and underwrite rents conservatively.

Bottom Line for Your Clients

Buyers: Conditions are more favourable—especially in Durham—than at any point since 2022. With another BoC decision on Oct 29, pre-approvals may improve slightly. Don’t chase; there’s still time to shop and negotiate inspection/financing terms.

Sellers: Price to market and stage aggressively. Expect longer DOM for most condos and some freehold pockets; best-in-class homes still move.

Investors: Underwrite for flat prices and soft rents near term. Focus on value-add layouts (separate entries, extra parking, secondary/garden suites permitted in Durham municipalities) and capex-light structures. If your horizon is 2027+, a thinner pipeline could set up better appreciation—but today’s cash flow must be manageable.

Disclaimer: The information provided is for general information purposes only and is drawn from sources believed to be reliable; however, no representation or warranty is made as to its accuracy or completeness. This content does not constitute legal, financial, or mortgage advice—please consult a qualified professional before making any real estate or financing decisions. Not intended to solicit buyers or sellers, landlords or tenants currently under contract.