Short answer: it depends. Power of Sale (PoS) properties can look like bargains, but the fine print—and the condition—determine whether you’re actually saving money or buying a headache.

What is a Power of Sale?

A Power of Sale occurs when a lender sells a property after the owner falls significantly behind on mortgage payments (often 3–6 months). Rather than foreclosing, the lender uses a contractual right to sell the home and recover what’s owed.

“Aren’t These the Best Deals?”

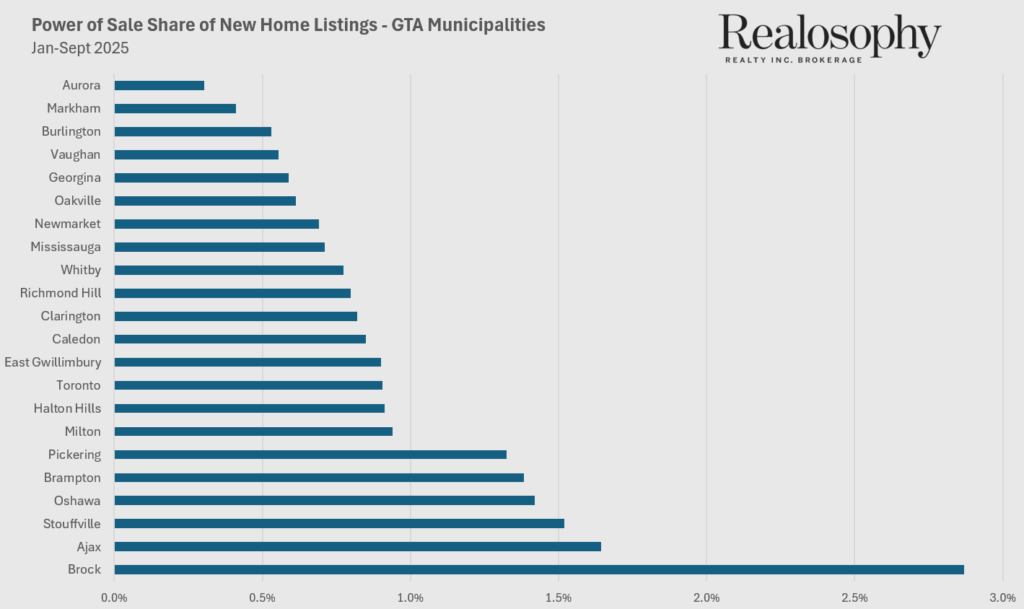

Not automatically. In today’s market, roughly 3% of listings on TRREB are Power of Sale. A large share of these properties are showing up in Brock, Ajax, and Stouffville.

These areas saw rapid growth during the pandemic and are not see sharp decrease. Here is the market correction for Brack, Ajax, and Whitchurch-Stouffville since peak of the market, Feb 2022.

Brock is down 37%

Ajax is down 32%

Whitchurch-Stouffville Is down 26%

Areas with the fewest power of sales? Aurora, Markham, and Burlington.

Here’s the catch: the lender must try to achieve fair market value. Typically, these listings sit for a set minimum time before offers are considered. When you submit an offer, expect a longer irrevocable (often ~3 days) so the lender’s lawyer can review—and to leave room for competing interest.

Thank you to Realosophy for the data on Power Of Sale listings in the GTA.

The Risk You’re Taking On

Power of Sale properties are sold “as is, where is,” with no representations or warranties. That means:

- No assurances about the furnace, A/C, plumbing, electrical, roof, or appliances

- Unknowns around permits or previous work

- Limited recourse if something’s wrong after closing

If you’re thinking, “I’ll just renovate,” remember: you’ll need your down payment (often 20%) plus renovation capital, which can be tied up long term. Surprise issues (foundation, knob-and-tube, mold, septic) can quickly erase any perceived discount.

Remember, in real estate, you want to tie up the least amount of cash into any property.

PoS vs. Turnkey: Which Wins?

If you’re an experienced renovator with a strong budget, reliable trades, and appetite for risk, a PoS can work—especially if you can quantify repairs and carry costs.

If you’re a typical end-user who values certainty, timelines, and move-in readiness, a turnkey property often pencils out better because:

- You avoid unpredictable repair bills

- You retain flexibility on financing and conditions

- You gain representations & warranties from a standard seller (in many cases), reducing downside risk

When a PoS Might Make Sense

- You can inspect thoroughly (and price the work accurately)

- You’re comfortable with as-is risk and potential liens/cleanup issues

- You’ve budgeted for overruns (10–20%+ contingency)

- You’re investing for value-add (not immediate comfort)

My Take

Power of Sale listings are not automatically “great deals.” Because lenders aim for market value and offer no warranties, you’re trading price optics for real risk. By the time you factor in repairs, time, stress, and capital tied up, a well-bought turnkey home often wins for most buyers.

If you’re curious whether a specific PoS is worth pursuing, I’ll walk you through a true cost breakdown: scope, trades, timelines, carrying costs, and resale or rental outlook. The math—not the headline—should make the decision.

Disclaimer: The information provided is for general information purposes only and is drawn from sources believed to be reliable; however, no representation or warranty is made as to its accuracy or completeness. This content does not constitute legal, financial, or mortgage advice—please consult a qualified professional before making any real estate or financing decisions. Not intended to solicit buyers or sellers, landlords or tenants currently under contract.