1) Median Price Analysis

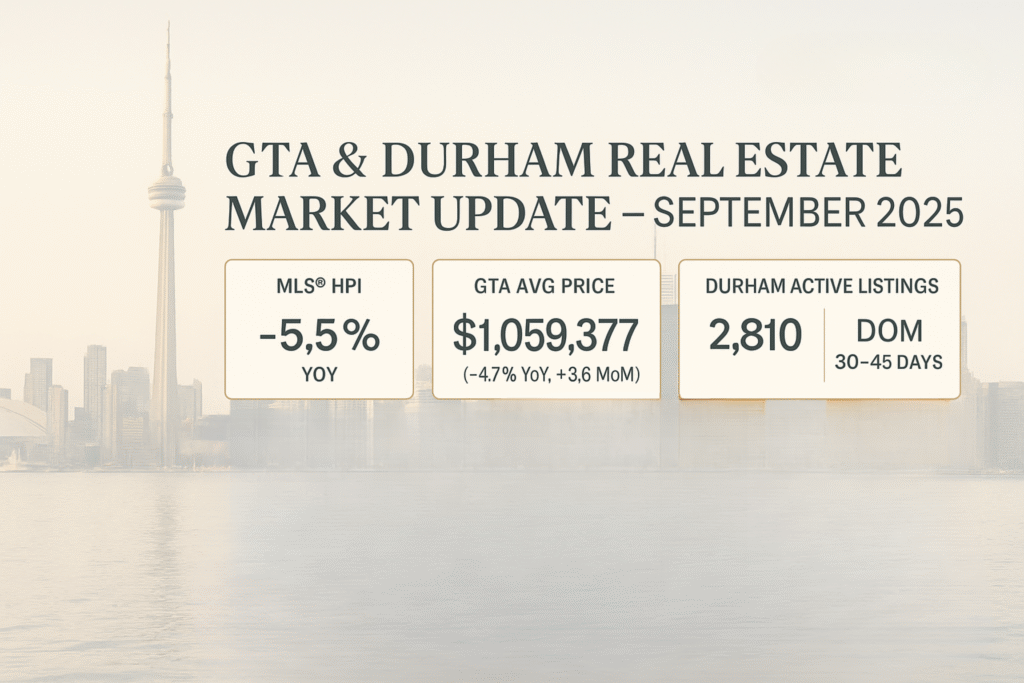

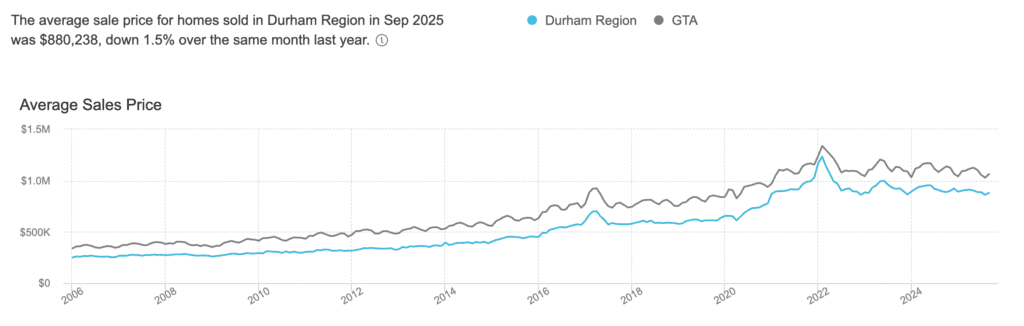

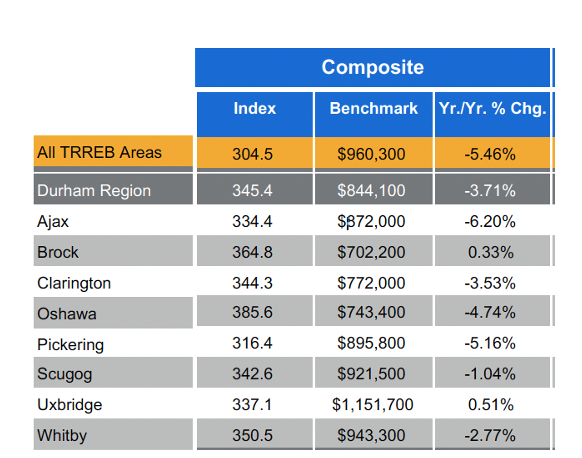

Home prices continue to trend down year over year – GTA & Durham Real Estate Market Update. The MLS® Benchmark Price declined 5.5% YoY.

The GTA average price is $1,059,377 (-4.7% YoY). Although the average price rose 3.6% month over month versus August ($1,022,143), that’s largely a composition effect, with August often being the slowest month.

Durham Region Snapshot

Durham saw increased sales activity consistent with the broader GTA. Prices continued to decline year over year amid higher supply: 2,810 active listings (up from 2,394 a year ago). On average, it currently takes 30–45 days for a home to sell in Durham.

Sales Activity & Direction

Sales rose following the September rate cut (5,592 sales; seasonally adjusted +2% MoM) but remain below long-term norms.

New listings also increased modestly, causing more listings to roll over into active listings.

Overall read: Mixed — the benchmark price edged down month over month while the average price ticked up on more higher-end activity. Year over year, both measures remain lower.

Are Prices Going Up or Down?

Prices are likely to remain under pressure into late 2025/early 2026 as additional supply comes to market.

Why supply may rise resulting in prices to remain fairly flat:

- Mortgage renewals: many owners will reset from ~1.5–2.0% to roughly 3.7–4.2%, lifting payments and nudging some to list their properties.

- Investor cash flow: higher carrying costs, more tenant turnover, and increased purpose-built rental supply are prompting some investors to exit.

- New completions: A large wave of 2025 condo and purpose-built rental completions is expected to add inventory to a supply-heavy market.

What’s Next? (12-Month View)

- Rates: The Bank of Canada policy rate is 2.50% (as of Sept 17, 2025). Baseline outlooks keep rates near this level into early 2026, with only modest further easing implied.

- Sales & prices: Expect mostly sideways to slightly softer conditions through late 2025, then gradual stabilisation in 2026 as rates hold near 2.5% and confidence improves — contingent on employment and inflation trends.

Is It a Good Time for Buyers or Sellers?

- Buyers: Conditions lean buyer-tilted to balanced — more inventory, longer DOM, and lower YoY prices mean more selection and negotiating room (especially condos and some entry-level freeholds).

- Sellers: Well-presented, accurately priced homes in desirable school zones still move, but pricing discipline is crucial; over-pricing risks stagnation given the added choice in the market.

2) Power of Sale (PoS) — Where and Why

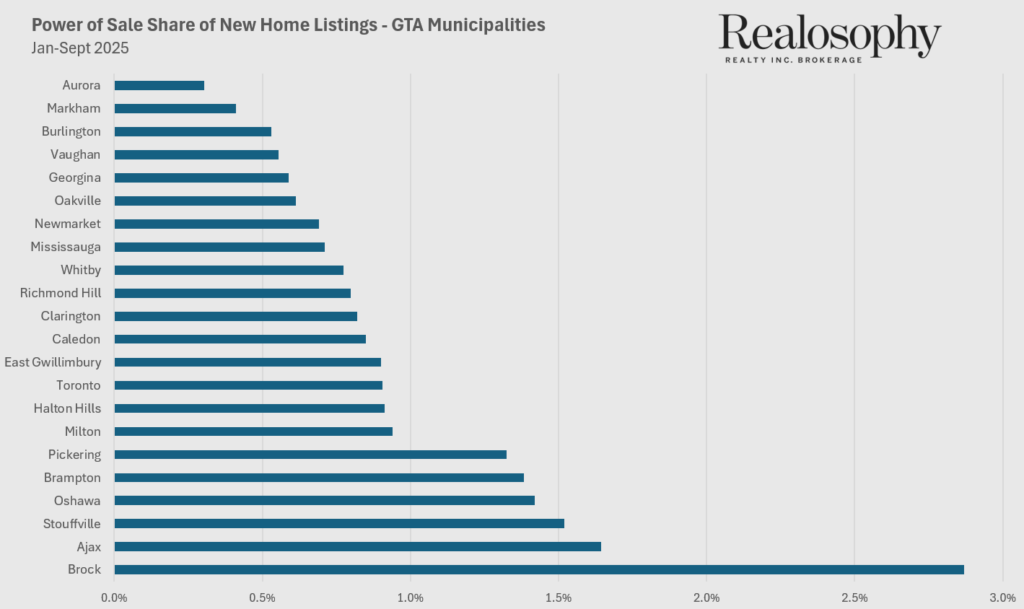

From January to September 2025, PoS listings were concentrated in the outer-suburban east and select 905 markets. Brock stands out with the highest PoS share by a wide margin, followed by Ajax, Stouffville, Oshawa, Brampton, and Pickering. A middle band—roughly around the GTA average—includes Milton, Halton Hills, Toronto, East Gwillimbury, Caledon, Clarington, Richmond Hill, and Whitby. At the low end of PoS share are higher-income or more supply-constrained municipalities such as Aurora, Markham, Burlington, and Vaughan (with Newmarket and Mississauga also nearer the lower range).

What this means: Areas that experienced some of the sharpest pandemic-era run-ups—and that tend to have more investor activity or payment-sensitive households—are seeing relatively more distressed listings. Conversely, markets with deeper buyer pools and stronger household incomes are showing fewer PoS events. Overall, PoS remains a small slice of total listings and its impact is highly local, varying by neighbourhood and price band.

Thank you to Realosophy for creating the following chart to summarize the data.

3) Bidding Wars Aren’t Working Right Now

For months, some sellers have tried the old play: list under value and hope a crowd of offers pushes the price up. In today’s market, that strategy is misfiring.

- Underpricing isn’t sparking frenzies — buyers want a deal, not a bidding war.

- The expectation gap is real — buyers are value-hunting while sellers still expect top dollar.

- Terminations and re-lists are climbing — missing offer night adds days on market and weakens leverage.

- Confidence beats gimmicks — transparent, market-aligned pricing brings serious showings and cleaner negotiations.

- Quality still wins — staging, strong visuals, pre-inspections, and flexible terms outperform teaser pricing.

Bottom Line

If you’re selling, price to market, present beautifully, and negotiate from strength. If you’re buying, this environment offers more selection and leverage — especially on re-listed homes.

Disclaimer: This material is for general information only and does not constitute financial, legal, or investment advice. Market conditions vary by neighbourhood and property type.